Your superannuation plays a big part in saving for your retirement. Because of this, you want to make sure that you are comfortable with where your savings are held and, importantly, who is in control of your money.

Super – you have choices

Most people know that they can choose how the money in their superannuation account is invested. For example, you can invest in cash, shares or managed funds. With the help of your financial adviser, you can choose the best combination of investments to suit you. But this is not the only choice you have when it comes to your super. You also have a choice about who is responsible for managing and controlling your superannuation savings.

It doesn’t matter where your super savings are invested, you will always have some level of responsibility over the money. The degree of your control is closely associated with the type of fund your money is invested in.

Types of super funds

There are a variety of super funds, each suit particular circumstances and needs. The most common types of funds are:

- Employer funds or corporate super plans, e.g. the AMP Staff Super Fund.

- Industry funds, including those catering for a particular industry, such as CBUS for the building industry.

- Personal funds. These funds are separate from an employer or industry fund and are run by a fund manager.

- DIY super funds, otherwise known as self-managed super funds. These funds are set up by an individual or a group of up to four people.

What is a self-managed super fund?

A self-managed superannuation fund has the same purpose as other super funds – to provide retirement benefits for its members.

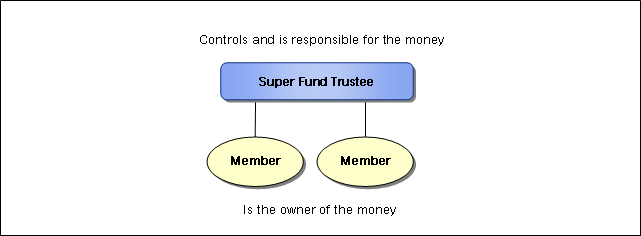

Like all super funds, a self-managed super fund is a trust. A trust is a legal arrangement where assets are managed by a person, a group of people, or a company, for the benefit of other people. The structure of a super fund can be explained as follows:

Trustee – controls the money on behalf of the members and is responsible for the reporting obligations and meeting the law.

- Members – the people who the fund is set up for: i.e. the “owners” of the savings.

To be classified as a self-managed fund, a super fund must meet a number of requirements. These are summarised in the table below.

| Requirements of an SMSF | |

| Sole purpose | An SMSF must be set up to provide retirement benefits to its members. If the members die before they retire, the fund can provide the savings to the member’s beneficiaries. The fund can never be used for business or personal purposes |

| Members are trustees | All members of an SMSF must be trustees of the fund. If the trustee of the SMSF is a company, all members must be directors of the company. |

| Trustees are members | The trustees of the SMSF must be members, except if the fund only has one member. |

| Up to four (4) members | A self-managed superannuation fund can have a maximum of 4 members |

| Member relationships | No member of an SMSF can be an employee of another member, unless the members are related. |

| Single member funds | If the fund only has one member, there are other requirements that must be met. If the trustee is a company, the single member can be: The sole director of the trustee company or One of only two directors of the trustee company. In this instance, the second director must not be an employee of the member, unless they are related If the trustee is not a company, there must be two trustees: One trustee being the member The other trustee, unless they are related must not be an employee of the member. |

| Payment of trustees | Trustees of SMSF cannot be paid for their duties as a trustee. |

What’s the difference between an SMSF and other types of super funds?

The main difference between a self-managed fund, and the other type of super funds is the control of the fund. As we have outlined above, all super funds are controlled by a trustee. In the case of industry funds, employer funds or personal funds, the trustee is an institution or large entity, such as a company. With an SMSF, the trustees are the members of the fund.

All superannuation funds are regulated by the Australian Prudential Regulation Authority (APRA), except for SMSFs who are regulated by the Australian Taxation Office (ATO). The major difference is that SMSF trustees are not protected in the event of fraud or theft.

If you set up an SMSF, you will be a member and a trustee. As a member, you will make contributions into your account and provide the trustee with instructions on how you want your money to be managed. Your involvement and responsibility as a trustee is different to that as a member. In your capacity as a trustee, you will be responsible for controlling and administering the fund and investing the money in line with the member’s requirements.

Another difference between other types of funds and an SMSF is the ability of a self-managed super fund to invest in a wider range of investments, such as specific types of property. But perhaps the most influential difference with an SMSF is that you have greater control over the investment of your super savings. This is because you are making the investment decisions. Let’s use an example to explain this further.

Scenario A

Your super is invested in ABC Corporate Super Fund. With the help of your financial adviser, you have decided to put your savings into the Balanced Fund investment option. The ABC Super Fund employs professional investment managers who decide how to invest the money, i.e. how to split it between asset classes such as cash, fixed interest and shares, and within those classes which particular investments to select. For example: they may invest some money with XYZ Bank and some with another fund manager.

Scenario B

You have an SMSF. As the member, you have told the trustee how much investment risk you are willing to accept. As the trustee, you now have to decide what mix of investments will meet the member’s requirements. Of course you can use the help of a financial adviser, but unlike Scenario A where ABC Super Fund trustees are responsible for making sure everything is done correctly, in this scenario you, as the trustee, are responsible for managing and administering your fund.

Running a SMSF is about responsibility as well as control!

As a trustee, how do I manage a SMSF?

As a trustee of an SMSF, there are strict rules you must follow. The rules provide guidance for administering the fund, as well as setting the boundaries that you can operate in. The table below summarises the things that govern how a trustee runs a fund.

| Requirements of an SMSF | |

| Super laws | Super laws apply to all super funds, regardless of the type. The laws include things like: Who can contribute to super When you can access your super The trustees must make sure these rules are adhered to. |

| The trust deed | All SMSFs must have a trust deed. A trust deed is a document that sets out the rules that your fund must operate under. If the trustees breach the trust deed the fund can be deemed non- complying, and the trustees may be penalised. |

| The investment strategy | All SMSF’s must have an investment strategy. This document sets out how the member’s money will be invested, and takes into consideration: The risks and returns associated with investing in particular asset classes The investment risk each member is willing to accept The cashflow and liquidity requirements of the fund How the fund will meet its expenses. |

| Other legislation | You must make sure you meet the rules set out in: The Tax Act; The Corporations Act; and Other government publications covering super, investments and taxation. |

As a trustee, what are my responsibilities?

As well as meeting the rules set out in the table above, a trustee must also keep records for the SMSF and its members. Most people use the services of professionals, such as accountants and auditors to meet record keeping requirements. You must also meet strict investment rules about where you can invest the member’s savings. The responsibilities of the trustee are summarised in the table below.

| Responsibilities of a Trustee | |

| Prepare and lodge annual financial statements and returns | Each year the fund must prepare financial statements and returns and lodge these with the ATO. You will need to pay an accountant to assist you with this. |

| Arrange for an annual audit | Each year you must have the fund audited, to ensure that it is being administered correctly. You will need to pay an auditor to do this. |

| Keep minutes to record decisions | To keep track of the decisions the trustees make, and when the members provide instructions, you will need to keep records. These can be referred to in the future and are helpful to protect the trustees if something goes wrong. |

| Set up an investment strategy for the members | All money must be invested in line with the investment strategy The investment strategy must be reviewed regularly and assessed against the investments to make sure that the members’ savings are invested in line with the strategy. It must also be reviewed to make sure the investment strategy continues to reflect the members’ needs. |

An SMSF must meet strict investment rules. These are set out in the sections below.

Investment Rule 1: Do not acquire assets from a related party

An SMSF cannot acquire assets from a related party, except where:

- The asset is a listed security (such as shares on the Australian Stock Exchange).

- The asset is property used wholly and exclusively in a business and purchased at market value.

- The asset is an in-house asset. An in-house asset is a loan to or an investment in a related party of your fund or a related trust of your fund. In-house assets can only make up 5 per cent of the fund’s total assets at the 30th of June each year.

A related party includes all members of the fund and their associates, and all employer-sponsors of your fund and their associates.

- An associate of the members includes:

- Every other member of the fund

- The relatives of each member

- The business partners of each member

- Any spouse or child of the business partners

- Any company or trust a member controls or influences

If the fund chooses to invest in an in-house asset, it needs to be done in a way that reflects the situation if the parties were unrelated i.e. on a commercial basis.

Investment Rule 2: Don’t provide financial help to members or their relatives

An SMSF cannot lend money or provide financial help (either directly or indirectly) to members of the fund, or the member’s relatives.

Investment Rule 3: Only borrow money in specific situations

An SMSF can only borrow money in the following circumstances:

- To pay benefits to a member or to pay for a member’s surcharge liability.

The borrowing can only be for a maximum of 90 days and must be less than 10 per cent of the fund’s total assets.

- To cover the settlement of investments bought on the share market.

The borrowing can only be for maximum of seven days and must be less than 10 per cent of the fund’s total assets.

- Borrowing using instalment warrants.

Instalment warrants are a sophisticated form of investing. For further information, speak to your financial adviser.

What happens if I don’t meet my responsibilities?

There are strict penalties for both the fund and you, as a trustee, if you do not meet the requirements for self-managed super funds. The penalties range from severe tax penalties that can seriously reduce your retirement savings, to prosecution.

If your SMSF meets all its requirements, it is deemed to be a “complying” fund. This allows your fund, and the members, to access the tax concessions that the government provides.

If your fund does not meet all of its requirements, it can be deemed “non-complying”. If this happens, your fund can be subject to tax rates of up to 45% on the income and assets.

If you do not meet your responsibilities, you can be disqualified as a trustee. As we have previously mentioned, all members of an SMSF must be trustees. If you are unable be a trustee, you are therefore also unable to continue to be a member of the fund. And finally, the most serious penalty you can face is prosecution.

What are the costs of running a SMSF?

There are costs associated with all super funds. These costs are shared amongst the funds members. When you invest in a personal, employer, or industry fund, you are charged fees. These fees can include:

- Administration costs

- Investment manager costs

- Transaction costs

The same goes for your SMSF. But, unlike other funds, where the costs can be shared between thousands of members, the fees of an SMSF are only shared between a maximum of four members. Because of this, SMSFs can become expensive compared with other options. Whether the costs are acceptable depends on how much money you have in super, and how important it is to you to have greater control over your money.

Who is a self-managed super fund appropriate for?

A self-managed super fund is not for everyone. The purpose of this fact sheet is to explain what an SMSF is and how it works. We have identified that a SMSF provides additional control to its members, but it is important to remember that with the additional control, comes added responsibility.

An SMSF is only appropriate for people who have the time, the desire, and the expertise to manage their super affairs correctly. As a general rule, an SMSF is most appropriate for:

- Sophisticated investors – that is, people with an understanding about investing and its risks.

- People who want additional control over their super savings.

- People who want flexibility around how their super is invested. Through a SMSF you can invest in certain types of assets that you could not through your employer, personal or industry fund, such as direct property that is used for business purposes.

- People with super savings over $200,000. This refers to the overall fund balance, rather than an individual member’s account.

- People who have particular needs or requirements for how their super assets are passed on once they die. SMSFs provide more estate planning options when a member dies.

- People who believe they can achieve a better result for their super than by investing through other types of super funds – whether this is reached by reducing costs, or by creating greater returns.

Is an SMSF right for me?

Managing your own SMSF can be time consuming and complicated.

Before considering an SMSF, you must give serious thought to whether you fit the bill. Is an SMSF really right for you? And more importantly, are you willing to accept the added responsibilities?

How do I start my own SMSF?

If you believe an SMSF may be suitable for you, or you want to find out more about how it could benefit your situation, we can provide you with more information on the subject and can also help you set up your fund.

Important information

This information is of a general nature only and is not intended to constitute personal advice. It does not take into account your particular investment objectives, financial situation or needs and, accordingly, you should consider the appropriateness of this information in light of your own circumstances. We recommend that you obtain professional advice before undertaking financial transactions.

Graham Chatterton is an Authorised Representative of:

Consilium Advice Pty Ltd ABN 86 158 826 647

Australian Financial Services Licence No. 424974

Level 11 37 Bligh Street SYDNEY NSW 2000

T: 02 8003 5111